For 95 years, Serve Credit Union’s rich history has been rooted in service. From the police officers of the Des Moines Police Department, to serving the employees and families of Public Safety, City, County, State, Federal, Schools, and Healthcare Facilities, we are proud to serve! Thank you for allowing us to be your Trusted Financial Partner, and we look forward to the next 95 years!

-

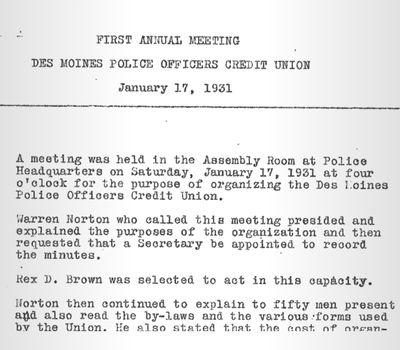

On January 17, 1931, a group of 50 men joined together

in the Assembly Room of the Des Moines Police Headquarters and organized

the Des Moines Police Officer's Credit Union. The official establishment date and the credit union's birthday is January 19, 1931.

Your credit union is the 5th oldest credit union in the State of Iowa!

- Warren Norton called the Meeting to order

- Rex Brown was the First Secretary

- Victor Smith and Arthur Hamilton were the First Tellers

- Rex Brown, L.L Eklund, Roger West, Warren Norton, Victor Smith, D.W Rayburn, Roy Chamberlain, Nels Pastel, and Harry Booton were the First Board of Directors

- H.A Alber, Sherm Dalmege, Frank Pierce, A.H Pederson, and J.O Enrich were the First Credit Committee

- J.R McClelland was the First Supervisory Committee

-

President Roosevelt signed the Federal Credit Union Act. Notice Anything? That's right, your credit union is older than the Federal Credit Union Act! The state charted Iowa Credit Union Act was signed into law several years prior in 1925, making Iowa Credit Unions over 100 years old!

-

Federal legislation passed in 1977 allowed credit unions to offer new services to members, such as share certificates and mortgages. Your credit union would soon after begin to explore these services to be a part of the "American Dream" for its members!

-

In 1980, the Depository Institutions Deregulation and Monetary Control Act was signed into law, granting credit unions the authority to issue Share Drafts, more commonly referred to as Checking Accounts. Your credit union would soon after introduce this product to its members!

-

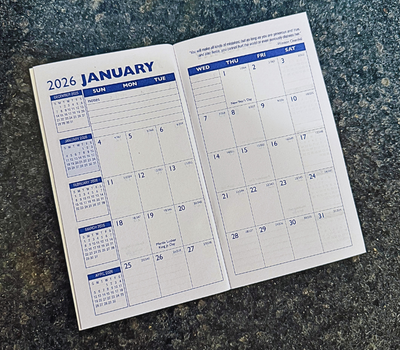

The beloved "Pocket Calendar" was officially introduced! This calendar was designed to fit into the front pocket of a police officer's uniform, and most commonly held reminders for upcoming "off duty gigs". For over 25 years, the Pocket Calendar has continued to remain a highly sought after item year after year.

-

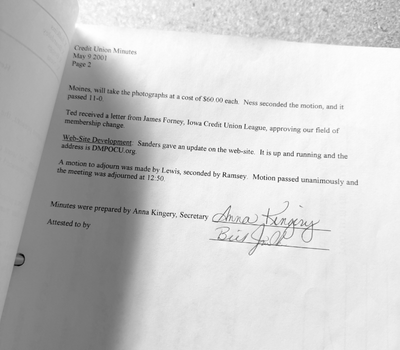

Your credit union made big strides in growth and technology by officially launching www.DMPOCU.org and ammending the bylaws to add "sisters, brothers, and grandchildren of the primary member" to the credit union! Prior to 2001, these relatives to the primary member were unable to join.

-

Your credit union found a new home at 423 E Court Ave. Here are a few excerpts from The Des Moines Register newspaper article:

- "We've always been pretty conservative, so it was a big move going from free rent in the police building to rented office space a few years ago. When I came on the board in the early 80's, we had assets of $3.2 million. Now we have $22 million in assets and we're moving into our own building!" - Lt. Jim Harkin

- "When I started here in 1971, Lt. Bill Wood had a box about the size of a shoe box with cards in it. He conducted business out of that box. People are emotionally connected to the credit union. First of all, it's financially sound, but it's also like family. For me, it's like going to Mom and Dad for a loan." - Anna Kingery

-

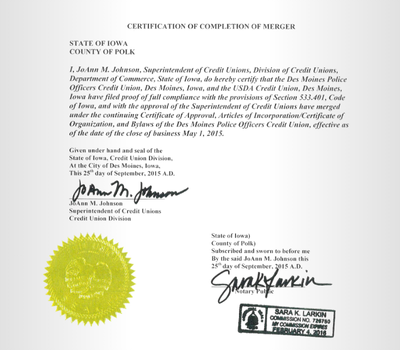

On May 1, 2015, USDA Credit Union completed their merger into Des Moines Police Officer's Credit Union.

Your credit union established its second branch inside the Federal Building to continue serving the members of the former USDA Credit Union.

-

On October 1, 2016, Polk County School Employees Credit Union completed their merger into Des Moines Police Officer's Credit Union.

Your credit union established its third branch at 3810 66th Street in Urbandale to continue serving the members of the former PCSE Credit Union.

-

On July 10, 2017, Des Moines Police Officer's Credit Union, with their newly merged membership, voted to change its name to Serve Credit Union. This name change marked an important day in your credit union's history, the day all members of Serve Credit Union felt welcomed to the mission, vision and inspiring story of serving those who serve others.

-

On May 1, 2018, Serve Credit Union relocated its Urbandale Branch to 3743 86th Street in Urbandale.

The new branch offered a better member experience through new technologies, a maintained parking lot for easier access, and a larger office space to serve more members.

-

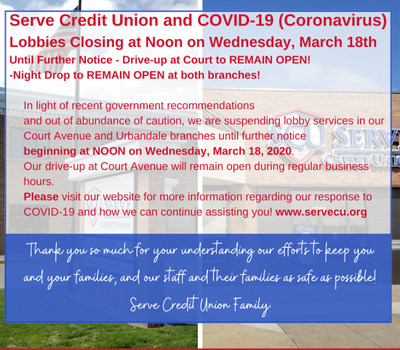

Serve Credit Union found meaningful ways to continue supporting and engaging with members throughout the COVID-19 pandemic.

While branch lobbies were temporarily closed, the team remained accessible through drive-thru service, Online Banking, mobile apps,

night drop access, and expanded digital tools. Your credit union also maintained personal connections with members through handwritten notes, surprise treat drop-offs, and the careful implementation of safety protocols that allowed for a gradual reopening of in-branch services.

One of the most welcomed milestones was the reintroduction of the beloved Cookie Friday tradition.

-

In January, the Blue Shoe Box Youth Program was launched! The program pays homage to the founders of the credit union operating out of a shoe box by bringing that little piece of history to youth member's homes!

Since its inception, over 120 youth members have participated in or graduated from the program and have learned about the credit union difference, products and services, financial literacy, and enjoyed many engagement events!

-

A partnership with First Community Trust was established to expand the services available to Serve Credit Union members, providing access to Wills, Trusts, Investments, and Insurance solutions.

This addition represented an important milestone in Serve Credit Union’s continued growth, further strengthening its role as a full-service, trusted financial partner for its members.

-

The Mission and Vision for Serve Credit Union was updated through a strategic planning session with members of the staff and Board of Directors.

- Mission: As a Trusted Financial Partner, we proudly serve those who serve our communities.

- Vision: Impacting the lives of our members and communities for generations to come.

The team also supported the members through a System Upgrade, marking significant enhancements to the member experience through new benefits and solutions and more effective technologies.

-

On February 15, 2025, the credit union's bylaws were updated to expand the current membership eligibility to reach the whole state of Iowa! Meaning any county restrictions were removed, and Serve Credit Union could now serve Public Safety, City, County, State Federal, and Schools across the state!

On October 14, 2025, the credit union's bylaws were updated to include Healthcare and Medical Professionals in Polk and contiguous counties. Because Serve Credit Union is not open to the general public, every new group added to the field of membership is intentional and aligns with the mission of "serving those who serve our commuities".

Our Mission

As a trusted financial partner, we proudly serve those who serve our communities.

Our Vision

Impacting the lives of our members and communities for generations to come.

About Credit Unions

Your credit union is a federally insured cooperative financial institution owned by its members. Unlike a bank or savings and loan association, a credit union is a not-for-profit financial cooperative and dedicated only to serving its members who share a common bond. Credit union members pool their money to make their collective savings available for low-cost loans to each other.

Since credit unions are not-for-profit, earnings are distributed to members either in the form of better rates on savings or rebates on loans or are invested in new or improved services for the members. Once you deposit money in the credit union, you become a member and shareholder. You can then vote for the credit union’s Board of Directors. Officers and directors are chosen from the membership and serve on a voluntary basis.

History-Established By Des Moines Police Officers

Serve Credit Union, one of the oldest in the state, began serving its members in 1931. Its purpose was to provide credit and savings to Des Moines police officers and their families at a fair and reasonable rate, to encourage habits of thrift, and to provide the opportunity to use and control their savings for their mutual benefit. Thanks to our loyal members, we’ve become a multi-million-dollar financial institution and are now able to provide a much wider selection of benefits and solutions. Over the years, we’ve grown to include all public safety professionals in the State of Iowa, such as but not limited to law enforcement, firefighters, correctional officers, and EMTs.

This growth also gave us the opportunity to merge with other like-minded credit unions, like the USDA Credit Union and the Polk County School Employees Credit Union. These mergers allow us to serve employees from governmental agencies and schools along with their families. This growth and change has been made possible by the integrity of our membership, allowing us to establish a long-standing tradition of providing low-interest loans and high-interest savings. We look forward to serving our members and giving them a strong financial choice for generations to come.

Board of Directors

A big thank you to those who serve as our volunteer Board of Directors!

| Executive Board |

|---|

| David Ness, Chairperson |

| Mike Morgan, Vice Chairperson |

| Gene Haigh, President |

| Eric Hartman, Secretary |

| Audit Committee |

|---|

| Dale Bruce, Chair |

| Duane Miller, Secretary |

| Nichole Benge |

| Credit Committee |

|---|

| Nick Brockman, Committee Chair |

| Jason Haigh, Secretary |

| Marty Trepp |

| Nominating Committee |

|---|

| Dale Bruce, Committee Chair |

| Dave Ness, Secretary |

| Mike Morgan |

| Honorary Board Member |

|---|

| Kevin Schneider |

94th Annual Report

The 94th Annual Meeting of Serve Credit Union was held on April 17th, 2025 at The Shop DSM Event Center.

Safety and Soundness

Serve Credit Union consistently receives high ratings from the Iowa Credit Union Regulatory Agency, confirming our sound management and safe lending practices. Our reserves are considerably above the national average of 10% for credit unions of our size. Each member’s savings are federally insured up to $250,000 by NCUA, a United States government agency.

Regulation and Supervision

Serve Credit Union was state-chartered in 1931 under the provisions of Chapter 533 of the Code of Iowa as the Des Moines Police Officers’ Credit Union. It is regulated by the Superintendent of Credit Unions, who is appointed by the governor to direct and regulate credit unions. The Iowa Credit Union Division of the Department of Commerce conducts annual audits and examinations.

NCUA

The National Credit Union Administration (NCUA) is the independent federal agency created by the U.S. Congress to regulate, charter, and supervise federal credit unions. With the backing of the full faith and credit of the U.S. Government, NCUA operates and manages the National Credit Union Share Insurance Fund, insuring the deposits of more than 92 million account holders up to $250,000 in all federal credit unions, and the overwhelming majority of state-chartered credit unions.